Hyperliquid Vault PnL Analysis

In this notebook, we demonstrate how to analyse the historical performance of a Hyperliquid vault by reconstructing its position history and visualising the equity curve (cumulative PnL).

What we’ll cover:

Fetching trade fills from Hyperliquid API for a specific vault

Reconstructing position events (opens, closes, increases, decreases) from fill data

Creating an analysis DataFrame with exposure and PnL tracking per market

Visualising the vault’s equity curve using Plotly

Analysing vault deposits and withdrawals (capital flows)

Combining PnL and deposits to visualise overall account value

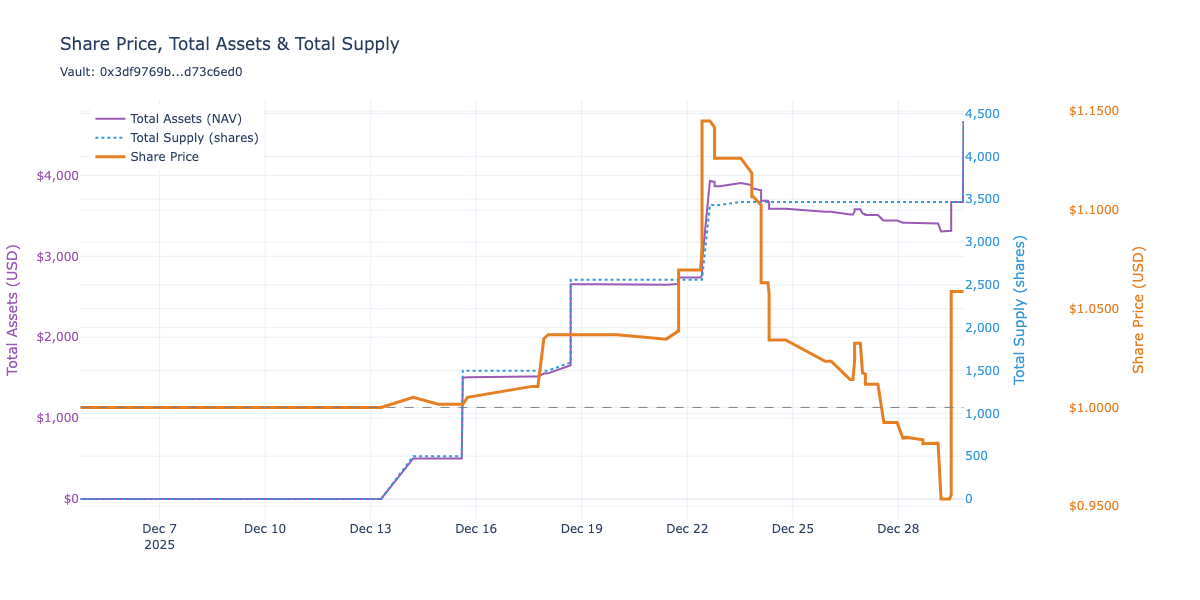

Calculating internal share price to measure true investment performance

About Hyperliquid Vaults:

Hyperliquid vaults are managed trading accounts where depositors delegate capital to vault managers who execute perpetual futures trading strategies. Unlike ERC-4626 vaults, Hyperliquid vaults operate natively on Hyperliquid Core, a specialised chain that is not EVM compatible.

Note: The Hyperliquid API has pagination limits (max 10,000 fills), so historical analysis is limited to recent trading activity.

For questions or feedback, contact Trading Strategy community.

Setup

Configure notebook display settings

Set up Plotly for static image output (for documentation rendering)

[29]:

import datetime

import pandas as pd

from plotly.offline import init_notebook_mode

import plotly.io as pio

import plotly.graph_objects as go

pd.options.display.float_format = "{:,.2f}".format

pd.options.display.max_columns = None

pd.options.display.max_rows = None

# Set up Plotly chart output

image_format = "png"

width = 1200

height = 600

init_notebook_mode()

pio.renderers.default = image_format

current_renderer = pio.renderers[image_format]

current_renderer.width = width

current_renderer.height = height

Vault Configuration

We’ll analyze the Trading Strategy - IchiV3 LS vault, which executes long/short perpetual futures strategies.

You can view this vault on the Hyperliquid app: https://app.hyperliquid.xyz/vaults/0x3df9769bbbb335340872f01d8157c779d73c6ed0

[30]:

# Vault address to analyze

VAULT_ADDRESS = "0x3df9769bbbb335340872f01d8157c779d73c6ed0"

# Time range for analysis (last 30 days by default)

END_TIME = datetime.datetime.now()

START_TIME = END_TIME - datetime.timedelta(days=30)

# Display configuration as a table

config_df = pd.DataFrame({

"Setting": ["Vault Address", "Start Date", "End Date"],

"Value": [VAULT_ADDRESS, START_TIME.strftime('%Y-%m-%d'), END_TIME.strftime('%Y-%m-%d')]

})

display(config_df.set_index("Setting"))

| Value | |

|---|---|

| Setting | |

| Vault Address | 0x3df9769bbbb335340872f01d8157c779d73c6ed0 |

| Start Date | 2025-11-30 |

| End Date | 2025-12-30 |

Fetch Trade Fills

First, we create an HTTP session configured with retry logic for the Hyperliquid API, then fetch all trade fills for the vault within our time range.

The API returns fills in reverse chronological order, but our fetch function automatically sorts them chronologically for position reconstruction.

[31]:

from eth_defi.hyperliquid.session import create_hyperliquid_session

from eth_defi.hyperliquid.position import fetch_vault_fills

# Create session with automatic retry logic

session = create_hyperliquid_session()

# Fetch fills for the vault

fills = list(fetch_vault_fills(

session,

VAULT_ADDRESS,

start_time=START_TIME,

end_time=END_TIME,

))

print(f"Fetched {len(fills)} fills")

# Show sample fills as a table

if fills:

sample_data = []

for fill in fills[:5]: # Show first 5 fills

sample_data.append({

"Coin": fill.coin,

"Side": fill.side,

"Size": float(fill.size),

"Price": float(fill.price),

"Time": fill.timestamp,

})

display(pd.DataFrame(sample_data))

Fetched 128 fills

| Coin | Side | Size | Price | Time | |

|---|---|---|---|---|---|

| 0 | ENA | B | 107.00 | 0.24 | 2025-12-01 06:07:19.756 |

| 1 | WLFI | B | 205.00 | 0.15 | 2025-12-02 11:01:08.209 |

| 2 | XRP | B | 23.00 | 2.19 | 2025-12-03 22:05:03.025 |

| 3 | ADA | A | 92.00 | 0.45 | 2025-12-04 01:01:07.787 |

| 4 | WLFI | A | 205.00 | 0.16 | 2025-12-04 18:01:21.837 |

Reconstruct Position History

The raw fills don’t directly tell us about position state. We need to process them chronologically to reconstruct position events:

Open: New position from flat

Close: Position closed to flat (realised PnL)

Increase: Position size increased

Decrease: Partial position reduction (realised PnL)

[32]:

from eth_defi.hyperliquid.position import reconstruct_position_history, get_position_summary

# Reconstruct position events from fills

events = list(reconstruct_position_history(fills))

print(f"Reconstructed {len(events)} position events")

# Show position summary per market as a table

summary = get_position_summary(events)

summary_data = []

for coin, stats in sorted(summary.items()):

summary_data.append({

"Market": coin,

"Total Trades": stats['total_trades'],

"Opens": stats['opens'],

"Closes": stats['closes'],

"Realised PnL": float(stats['total_realized_pnl']),

"Total Fees": float(stats['total_fees']),

})

summary_df = pd.DataFrame(summary_data).set_index("Market")

display(summary_df)

Reconstructed 129 position events

| Total Trades | Opens | Closes | Realised PnL | Total Fees | |

|---|---|---|---|---|---|

| Market | |||||

| 0G | 7 | 1 | 1 | 0.76 | 0.59 |

| AAVE | 4 | 1 | 1 | 96.61 | 0.66 |

| ACE | 13 | 5 | 5 | -125.76 | 2.42 |

| ADA | 2 | 1 | 1 | -1.87 | 0.04 |

| APEX | 2 | 1 | 1 | -3.02 | 0.04 |

| APT | 2 | 1 | 1 | -30.65 | 0.64 |

| ARB | 2 | 1 | 1 | -0.98 | 0.02 |

| AVNT | 6 | 1 | 1 | -75.53 | 0.69 |

| BTC | 3 | 2 | 1 | -0.40 | 0.37 |

| CC | 3 | 1 | 1 | -16.09 | 0.25 |

| CRV | 2 | 1 | 1 | 0.49 | 0.02 |

| DOGE | 2 | 1 | 1 | 1.07 | 0.02 |

| ENA | 1 | 1 | 0 | 0.00 | 0.01 |

| HBAR | 2 | 1 | 1 | 2.63 | 0.01 |

| HYPE | 5 | 2 | 1 | 0.00 | 0.28 |

| LDO | 4 | 1 | 1 | -5.77 | 0.23 |

| LTC | 3 | 1 | 0 | 0.00 | 0.41 |

| MERL | 5 | 1 | 1 | -33.83 | 0.64 |

| MON | 7 | 2 | 1 | -48.90 | 0.96 |

| SEI | 2 | 1 | 1 | -0.52 | 0.02 |

| SUI | 2 | 1 | 1 | 0.86 | 0.03 |

| TAO | 2 | 1 | 1 | -0.87 | 0.02 |

| TRX | 4 | 2 | 2 | -2.91 | 0.23 |

| USTC | 2 | 1 | 1 | -1.43 | 0.02 |

| VVV | 8 | 2 | 1 | 32.01 | 0.96 |

| WIF | 1 | 1 | 0 | 0.00 | 0.05 |

| WLD | 2 | 1 | 1 | 0.58 | 0.02 |

| WLFI | 8 | 3 | 3 | -10.09 | 0.31 |

| XPL | 4 | 1 | 1 | -13.63 | 0.24 |

| XRP | 4 | 1 | 0 | -2.51 | 0.07 |

| ZEC | 13 | 4 | 4 | 249.09 | 2.18 |

| ZORA | 2 | 1 | 1 | 1.53 | 0.02 |

Create Analysis DataFrame

Now we convert the position events into a pandas DataFrame suitable for analysis. The DataFrame tracks:

Exposure: Notional value (size × price) for each position direction per market

PnL: Cumulative realised profit/loss for each direction per market

Column naming convention: - {coin}_long_exposure / {coin}_long_pnl - {coin}_short_exposure / {coin}_short_pnl

[33]:

from eth_defi.hyperliquid.position_analysis import create_account_dataframe

# Create the analysis DataFrame

df = create_account_dataframe(events)

# Display DataFrame info as a table

info_df = pd.DataFrame({

"Metric": ["Rows", "Columns", "Start Time", "End Time"],

"Value": [df.shape[0], df.shape[1], str(df.index.min()), str(df.index.max())]

})

display(info_df.set_index("Metric"))

# Show the last few rows

display(df.tail())

| Value | |

|---|---|

| Metric | |

| Rows | 129 |

| Columns | 128 |

| Start Time | 2025-12-01 06:07:19.756000 |

| End Time | 2025-12-29 20:07:28.020000 |

| 0G_long_exposure | 0G_long_pnl | 0G_short_exposure | 0G_short_pnl | AAVE_long_exposure | AAVE_long_pnl | AAVE_short_exposure | AAVE_short_pnl | ACE_long_exposure | ACE_long_pnl | ACE_short_exposure | ACE_short_pnl | ADA_long_exposure | ADA_long_pnl | ADA_short_exposure | ADA_short_pnl | APEX_long_exposure | APEX_long_pnl | APEX_short_exposure | APEX_short_pnl | APT_long_exposure | APT_long_pnl | APT_short_exposure | APT_short_pnl | ARB_long_exposure | ARB_long_pnl | ARB_short_exposure | ARB_short_pnl | AVNT_long_exposure | AVNT_long_pnl | AVNT_short_exposure | AVNT_short_pnl | BTC_long_exposure | BTC_long_pnl | BTC_short_exposure | BTC_short_pnl | CC_long_exposure | CC_long_pnl | CC_short_exposure | CC_short_pnl | CRV_long_exposure | CRV_long_pnl | CRV_short_exposure | CRV_short_pnl | DOGE_long_exposure | DOGE_long_pnl | DOGE_short_exposure | DOGE_short_pnl | ENA_long_exposure | ENA_long_pnl | ENA_short_exposure | ENA_short_pnl | HBAR_long_exposure | HBAR_long_pnl | HBAR_short_exposure | HBAR_short_pnl | HYPE_long_exposure | HYPE_long_pnl | HYPE_short_exposure | HYPE_short_pnl | LDO_long_exposure | LDO_long_pnl | LDO_short_exposure | LDO_short_pnl | LTC_long_exposure | LTC_long_pnl | LTC_short_exposure | LTC_short_pnl | MERL_long_exposure | MERL_long_pnl | MERL_short_exposure | MERL_short_pnl | MON_long_exposure | MON_long_pnl | MON_short_exposure | MON_short_pnl | SEI_long_exposure | SEI_long_pnl | SEI_short_exposure | SEI_short_pnl | SUI_long_exposure | SUI_long_pnl | SUI_short_exposure | SUI_short_pnl | TAO_long_exposure | TAO_long_pnl | TAO_short_exposure | TAO_short_pnl | TRX_long_exposure | TRX_long_pnl | TRX_short_exposure | TRX_short_pnl | USTC_long_exposure | USTC_long_pnl | USTC_short_exposure | USTC_short_pnl | VVV_long_exposure | VVV_long_pnl | VVV_short_exposure | VVV_short_pnl | WIF_long_exposure | WIF_long_pnl | WIF_short_exposure | WIF_short_pnl | WLD_long_exposure | WLD_long_pnl | WLD_short_exposure | WLD_short_pnl | WLFI_long_exposure | WLFI_long_pnl | WLFI_short_exposure | WLFI_short_pnl | XPL_long_exposure | XPL_long_pnl | XPL_short_exposure | XPL_short_pnl | XRP_long_exposure | XRP_long_pnl | XRP_short_exposure | XRP_short_pnl | ZEC_long_exposure | ZEC_long_pnl | ZEC_short_exposure | ZEC_short_pnl | ZORA_long_exposure | ZORA_long_pnl | ZORA_short_exposure | ZORA_short_pnl | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| timestamp | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2025-12-29 13:05:31.428 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 96.61 | 0.00 | -18.65 | 0.00 | -107.11 | 0.00 | 0.00 | 0.00 | -1.87 | 0.00 | 0.00 | 0.00 | -3.02 | 0.00 | 0.00 | 0.00 | -30.65 | 0.00 | 0.00 | 0.00 | -0.98 | 0.00 | 0.00 | 0.00 | -75.53 | 0.00 | -0.40 | 773.20 | 0.00 | 0.00 | -16.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.49 | 0.00 | 0.00 | 0.00 | 1.07 | 26.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63 | 18.81 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.77 | 0.00 | 0.00 | 908.15 | 0.00 | 0.00 | -33.83 | 0.00 | 0.00 | 0.00 | 0.00 | 712.96 | -48.90 | 0.00 | -0.52 | 0.00 | 0.00 | 0.00 | 0.86 | 0.00 | 0.00 | 0.00 | -0.87 | 0.00 | 0.00 | 0.00 | -0.07 | 0.00 | -2.84 | 0.00 | -1.43 | 0.00 | 0.00 | 689.13 | 32.01 | 0.00 | 0.00 | 0.00 | 0.00 | 116.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.58 | 0.00 | -0.17 | 0.00 | -9.92 | 0.00 | 0.00 | 0.00 | -13.63 | 47.55 | -2.51 | 0.00 | 0.00 | 0.00 | 226.89 | 0.00 | 22.20 | 0.00 | 0.00 | 0.00 | 1.53 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 96.61 | 0.00 | -18.65 | 0.00 | -107.11 | 0.00 | 0.00 | 0.00 | -1.87 | 0.00 | 0.00 | 0.00 | -3.02 | 0.00 | 0.00 | 0.00 | -30.65 | 0.00 | 0.00 | 0.00 | -0.98 | 0.00 | 0.00 | 0.00 | -75.53 | 0.00 | -0.40 | 773.20 | 0.00 | 0.00 | -16.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.49 | 0.00 | 0.00 | 0.00 | 1.07 | 26.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.77 | 0.00 | 0.00 | 908.15 | 0.00 | 0.00 | -33.83 | 0.00 | 0.00 | 0.00 | 0.00 | 712.96 | -48.90 | 0.00 | -0.52 | 0.00 | 0.00 | 0.00 | 0.86 | 0.00 | 0.00 | 0.00 | -0.87 | 0.00 | 0.00 | 0.00 | -0.07 | 0.00 | -2.84 | 0.00 | -1.43 | 0.00 | 0.00 | 689.13 | 32.01 | 0.00 | 0.00 | 0.00 | 0.00 | 116.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.58 | 0.00 | -0.17 | 0.00 | -9.92 | 0.00 | 0.00 | 0.00 | -13.63 | 47.55 | -2.51 | 0.00 | 0.00 | 0.00 | 226.89 | 0.00 | 22.20 | 0.00 | 0.00 | 0.00 | 1.53 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 96.61 | 0.00 | -18.65 | 0.00 | -107.11 | 0.00 | 0.00 | 0.00 | -1.87 | 0.00 | 0.00 | 0.00 | -3.02 | 0.00 | 0.00 | 0.00 | -30.65 | 0.00 | 0.00 | 0.00 | -0.98 | 0.00 | 0.00 | 0.00 | -75.53 | 0.00 | -0.40 | 773.20 | 0.00 | 0.00 | -16.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.49 | 0.00 | 0.00 | 0.00 | 1.07 | 26.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63 | 0.00 | 0.00 | 27.13 | 0.00 | 0.00 | 0.00 | 0.00 | -5.77 | 0.00 | 0.00 | 908.15 | 0.00 | 0.00 | -33.83 | 0.00 | 0.00 | 0.00 | 0.00 | 712.96 | -48.90 | 0.00 | -0.52 | 0.00 | 0.00 | 0.00 | 0.86 | 0.00 | 0.00 | 0.00 | -0.87 | 0.00 | 0.00 | 0.00 | -0.07 | 0.00 | -2.84 | 0.00 | -1.43 | 0.00 | 0.00 | 689.13 | 32.01 | 0.00 | 0.00 | 0.00 | 0.00 | 116.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.58 | 0.00 | -0.17 | 0.00 | -9.92 | 0.00 | 0.00 | 0.00 | -13.63 | 47.55 | -2.51 | 0.00 | 0.00 | 0.00 | 226.89 | 0.00 | 22.20 | 0.00 | 0.00 | 0.00 | 1.53 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 96.61 | 0.00 | -18.65 | 0.00 | -107.11 | 0.00 | 0.00 | 0.00 | -1.87 | 0.00 | 0.00 | 0.00 | -3.02 | 0.00 | 0.00 | 0.00 | -30.65 | 0.00 | 0.00 | 0.00 | -0.98 | 0.00 | 0.00 | 0.00 | -75.53 | 0.00 | -0.40 | 773.20 | 0.00 | 0.00 | -16.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.49 | 0.00 | 0.00 | 0.00 | 1.07 | 26.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63 | 0.00 | 0.00 | 73.30 | 0.00 | 0.00 | 0.00 | 0.00 | -5.77 | 0.00 | 0.00 | 908.15 | 0.00 | 0.00 | -33.83 | 0.00 | 0.00 | 0.00 | 0.00 | 712.96 | -48.90 | 0.00 | -0.52 | 0.00 | 0.00 | 0.00 | 0.86 | 0.00 | 0.00 | 0.00 | -0.87 | 0.00 | 0.00 | 0.00 | -0.07 | 0.00 | -2.84 | 0.00 | -1.43 | 0.00 | 0.00 | 689.13 | 32.01 | 0.00 | 0.00 | 0.00 | 0.00 | 116.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.58 | 0.00 | -0.17 | 0.00 | -9.92 | 0.00 | 0.00 | 0.00 | -13.63 | 47.55 | -2.51 | 0.00 | 0.00 | 0.00 | 226.89 | 0.00 | 22.20 | 0.00 | 0.00 | 0.00 | 1.53 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 96.61 | 0.00 | -18.65 | 0.00 | -107.11 | 0.00 | 0.00 | 0.00 | -1.87 | 0.00 | 0.00 | 0.00 | -3.02 | 0.00 | 0.00 | 0.00 | -30.65 | 0.00 | 0.00 | 0.00 | -0.98 | 0.00 | 0.00 | 0.00 | -75.53 | 0.00 | -0.40 | 773.20 | 0.00 | 0.00 | -16.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.49 | 0.00 | 0.00 | 0.00 | 1.07 | 26.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63 | 0.00 | 0.00 | 535.20 | 0.00 | 0.00 | 0.00 | 0.00 | -5.77 | 0.00 | 0.00 | 908.15 | 0.00 | 0.00 | -33.83 | 0.00 | 0.00 | 0.00 | 0.00 | 712.96 | -48.90 | 0.00 | -0.52 | 0.00 | 0.00 | 0.00 | 0.86 | 0.00 | 0.00 | 0.00 | -0.87 | 0.00 | 0.00 | 0.00 | -0.07 | 0.00 | -2.84 | 0.00 | -1.43 | 0.00 | 0.00 | 689.13 | 32.01 | 0.00 | 0.00 | 0.00 | 0.00 | 116.52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.58 | 0.00 | -0.17 | 0.00 | -9.92 | 0.00 | 0.00 | 0.00 | -13.63 | 47.55 | -2.51 | 0.00 | 0.00 | 0.00 | 226.89 | 0.00 | 22.20 | 0.00 | 0.00 | 0.00 | 1.53 |

Calculate Total Account PnL

The total account PnL at any point in time is the sum of all *_pnl columns. This represents the cumulative realised profit/loss across all markets and directions.

[34]:

# Find all PnL columns

pnl_columns = [col for col in df.columns if col.endswith('_pnl')]

# Calculate total PnL

df['total_pnl'] = df[pnl_columns].sum(axis=1)

# Show PnL statistics as a table

final_pnl = df['total_pnl'].iloc[-1]

max_pnl = df['total_pnl'].max()

min_pnl = df['total_pnl'].min()

stats_df = pd.DataFrame({

"Metric": ["Final PnL", "Max PnL", "Min PnL", "PnL Columns"],

"Value": [f"${final_pnl:,.2f}", f"${max_pnl:,.2f}", f"${min_pnl:,.2f}", len(pnl_columns)]

})

display(stats_df.set_index("Metric"))

| Value | |

|---|---|

| Metric | |

| Final PnL | $10.85 |

| Max PnL | $160.26 |

| Min PnL | $-171.32 |

| PnL Columns | 64 |

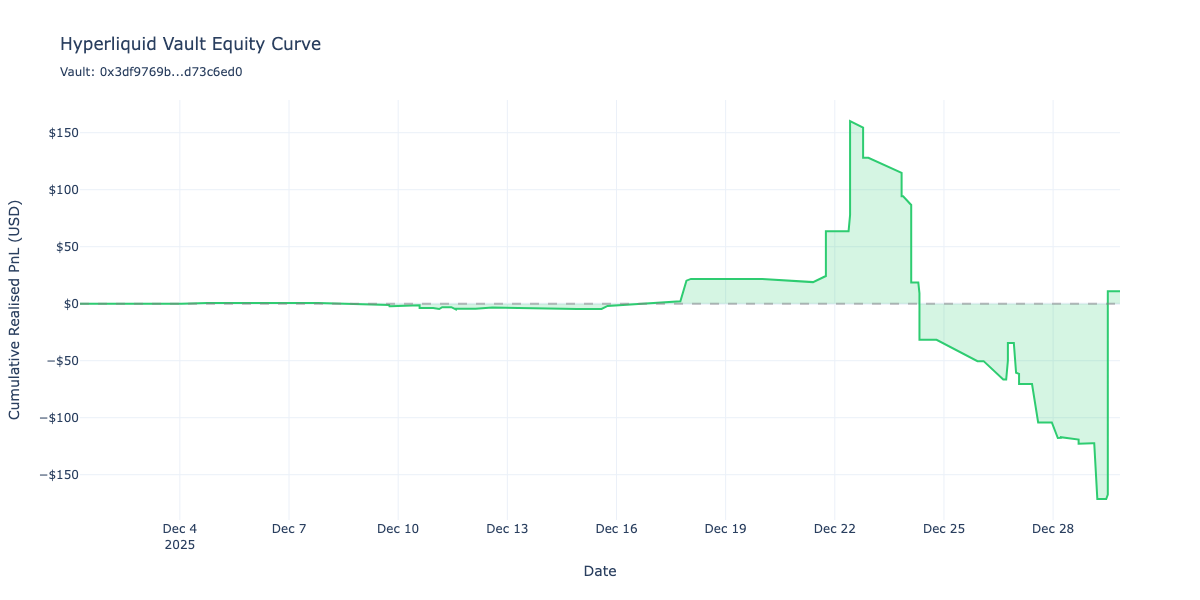

Visualise profit and loss

The equity curve shows how the vault’s cumulative realised PnL evolves over time. This is the key metric for evaluating trading performance.

We use Plotly for interactive visualisation (rendered as static image in documentation).

Note: This profit and loss does not account for vault deposits.

[35]:

# Create equity curve chart

fig = go.Figure()

fig.add_trace(go.Scatter(

x=df.index,

y=df['total_pnl'],

mode='lines',

name='Cumulative PnL',

line=dict(color='#2ecc71', width=2),

fill='tozeroy',

fillcolor='rgba(46, 204, 113, 0.2)',

))

# Add zero line

fig.add_hline(y=0, line_dash="dash", line_color="grey", opacity=0.5)

fig.update_layout(

title=f"Hyperliquid Vault Equity Curve<br><sub>Vault: {VAULT_ADDRESS[:10]}...{VAULT_ADDRESS[-8:]}</sub>",

xaxis_title="Date",

yaxis_title="Cumulative Realised PnL (USD)",

template="plotly_white",

hovermode="x unified",

yaxis=dict(tickformat="$,.0f"),

)

fig.show()

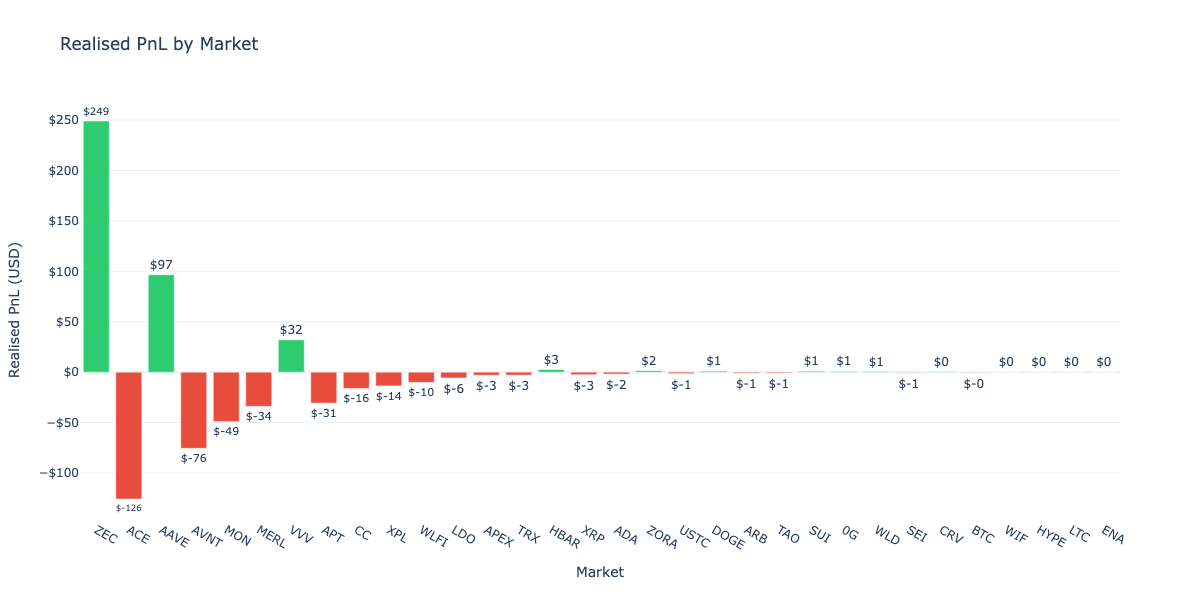

Per-Market PnL Breakdown

Let’s visualise the PnL contribution from each market to understand which assets drove performance.

[36]:

# Calculate total PnL per market (combining long and short)

markets = set(col.rsplit('_', 2)[0] for col in pnl_columns)

market_pnl = {}

for market in markets:

long_col = f"{market}_long_pnl"

short_col = f"{market}_short_pnl"

total = 0

if long_col in df.columns:

total += df[long_col].iloc[-1]

if short_col in df.columns:

total += df[short_col].iloc[-1]

market_pnl[market] = total

# Sort by absolute PnL

sorted_markets = sorted(market_pnl.items(), key=lambda x: abs(x[1]), reverse=True)

# Create bar chart

fig = go.Figure()

colours = ['#2ecc71' if pnl >= 0 else '#e74c3c' for _, pnl in sorted_markets]

fig.add_trace(go.Bar(

x=[m[0] for m in sorted_markets],

y=[m[1] for m in sorted_markets],

marker_color=colours,

text=[f"${pnl:,.0f}" for _, pnl in sorted_markets],

textposition='outside',

))

fig.update_layout(

title="Realised PnL by Market",

xaxis_title="Market",

yaxis_title="Realised PnL (USD)",

template="plotly_white",

yaxis=dict(tickformat="$,.0f"),

)

fig.show()

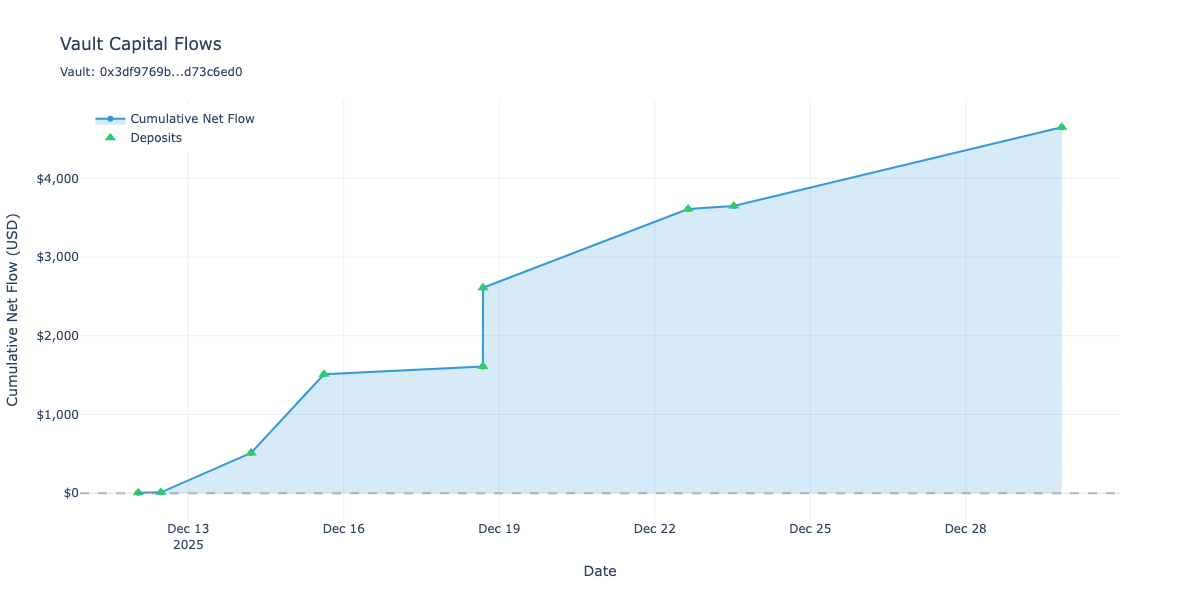

Vault deposits and withdrawals

Hyperliquid vaults track capital flows through deposits and withdrawals. Understanding these flows is crucial for analysing vault performance in context:

Deposits: Capital added by followers/investors

Withdrawals: Capital removed by followers (subject to lockup periods)

Net flow: Deposits minus withdrawals indicates investor sentiment

We use the userNonFundingLedgerUpdates API endpoint to fetch these events.

[37]:

from eth_defi.hyperliquid.deposit import fetch_vault_deposits, create_deposit_dataframe, get_deposit_summary

# Fetch deposit/withdrawal events for the vault

deposit_events = list(fetch_vault_deposits(

session,

VAULT_ADDRESS,

start_time=START_TIME,

end_time=END_TIME,

))

print(f"Fetched {len(deposit_events)} deposit/withdrawal events")

# Create DataFrame for analysis

deposits_df = create_deposit_dataframe(deposit_events)

# Show summary statistics

summary = get_deposit_summary(deposit_events)

summary_table = pd.DataFrame({

"Metric": [

"Total Events",

"Deposits",

"Withdrawals",

"Total Deposited (USD)",

"Total Withdrawn (USD)",

"Net Flow (USD)",

],

"Value": [

summary["total_events"],

summary["deposits"],

summary["withdrawals"],

f"${float(summary['total_deposited']):,.2f}",

f"${float(summary['total_withdrawn']):,.2f}",

f"${float(summary['net_flow']):,.2f}",

]

})

display(summary_table.set_index("Metric"))

# Show individual events

if not deposits_df.empty:

display(deposits_df[["event_type", "usdc"]].head(10))

Fetched 9 deposit/withdrawal events

| Value | |

|---|---|

| Metric | |

| Total Events | 9 |

| Deposits | 9 |

| Withdrawals | 0 |

| Total Deposited (USD) | $4,650.00 |

| Total Withdrawn (USD) | $0.00 |

| Net Flow (USD) | $4,650.00 |

| event_type | usdc | |

|---|---|---|

| timestamp | ||

| 2025-12-12 00:49:31.304 | vault_deposit | 5.00 |

| 2025-12-12 11:22:01.764 | vault_deposit | 5.00 |

| 2025-12-14 05:03:02.056 | vault_deposit | 500.00 |

| 2025-12-15 14:51:27.419 | vault_deposit | 1,000.00 |

| 2025-12-18 16:25:59.419 | vault_deposit | 100.00 |

| 2025-12-18 16:29:23.102 | vault_deposit | 1,000.00 |

| 2025-12-22 15:27:58.562 | vault_deposit | 1,000.00 |

| 2025-12-23 12:33:40.758 | vault_deposit | 40.00 |

| 2025-12-29 20:28:58.122 | vault_deposit | 1,000.00 |

Visualise cumulative capital flows

This chart shows how capital has flowed into and out of the vault over time. A rising line indicates net inflows (more deposits than withdrawals), while a falling line indicates net outflows.

[38]:

if not deposits_df.empty:

# Calculate cumulative flows

deposits_df["cumulative_flow"] = deposits_df["usdc"].cumsum()

# Create the chart

fig = go.Figure()

# Add cumulative flow line

fig.add_trace(go.Scatter(

x=deposits_df.index,

y=deposits_df["cumulative_flow"],

mode="lines+markers",

name="Cumulative Net Flow",

line=dict(color="#3498db", width=2),

fill="tozeroy",

fillcolor="rgba(52, 152, 219, 0.2)",

))

# Add individual events as markers

deposit_mask = deposits_df["event_type"] == "vault_deposit"

withdraw_mask = deposits_df["event_type"] == "vault_withdraw"

if deposit_mask.any():

fig.add_trace(go.Scatter(

x=deposits_df[deposit_mask].index,

y=deposits_df[deposit_mask]["cumulative_flow"],

mode="markers",

name="Deposits",

marker=dict(color="#2ecc71", size=10, symbol="triangle-up"),

text=[f"${v:,.0f}" for v in deposits_df[deposit_mask]["usdc"]],

hovertemplate="%{text}<extra>Deposit</extra>",

))

if withdraw_mask.any():

fig.add_trace(go.Scatter(

x=deposits_df[withdraw_mask].index,

y=deposits_df[withdraw_mask]["cumulative_flow"],

mode="markers",

name="Withdrawals",

marker=dict(color="#e74c3c", size=10, symbol="triangle-down"),

text=[f"${abs(v):,.0f}" for v in deposits_df[withdraw_mask]["usdc"]],

hovertemplate="%{text}<extra>Withdrawal</extra>",

))

fig.add_hline(y=0, line_dash="dash", line_color="grey", opacity=0.5)

fig.update_layout(

title=f"Vault Capital Flows<br><sub>Vault: {VAULT_ADDRESS[:10]}...{VAULT_ADDRESS[-8:]}</sub>",

xaxis_title="Date",

yaxis_title="Cumulative Net Flow (USD)",

template="plotly_white",

hovermode="x unified",

yaxis=dict(tickformat="$,.0f"),

legend=dict(yanchor="top", y=0.99, xanchor="left", x=0.01),

)

fig.show()

else:

print("No deposit/withdrawal events in the selected time period")

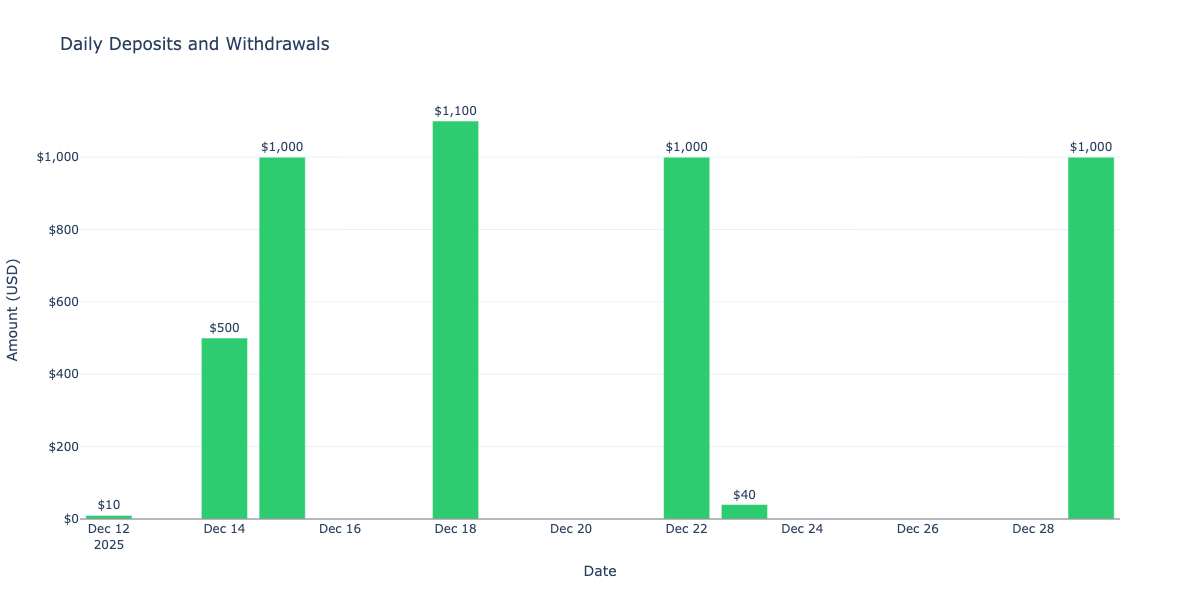

Daily deposit and withdrawal bar chart

This chart shows the daily breakdown of deposits (green, positive) and withdrawals (red, negative) to identify patterns in investor behaviour.

[39]:

if not deposits_df.empty:

# Aggregate by date

deposits_df["date"] = deposits_df.index.date

# Separate deposits and withdrawals

daily_deposits = deposits_df[deposits_df["usdc"] > 0].groupby("date")["usdc"].sum()

daily_withdrawals = deposits_df[deposits_df["usdc"] < 0].groupby("date")["usdc"].sum()

# Create figure with bars

fig = go.Figure()

if not daily_deposits.empty:

fig.add_trace(go.Bar(

x=daily_deposits.index,

y=daily_deposits.values,

name="Deposits",

marker_color="#2ecc71",

text=[f"${v:,.0f}" for v in daily_deposits.values],

textposition="outside",

))

if not daily_withdrawals.empty:

fig.add_trace(go.Bar(

x=daily_withdrawals.index,

y=daily_withdrawals.values,

name="Withdrawals",

marker_color="#e74c3c",

text=[f"${abs(v):,.0f}" for v in daily_withdrawals.values],

textposition="outside",

))

fig.add_hline(y=0, line_color="grey", opacity=0.5)

fig.update_layout(

title="Daily Deposits and Withdrawals",

xaxis_title="Date",

yaxis_title="Amount (USD)",

template="plotly_white",

barmode="relative",

yaxis=dict(tickformat="$,.0f"),

legend=dict(yanchor="top", y=0.99, xanchor="right", x=0.99),

)

fig.show()

else:

print("No deposit/withdrawal events in the selected time period")

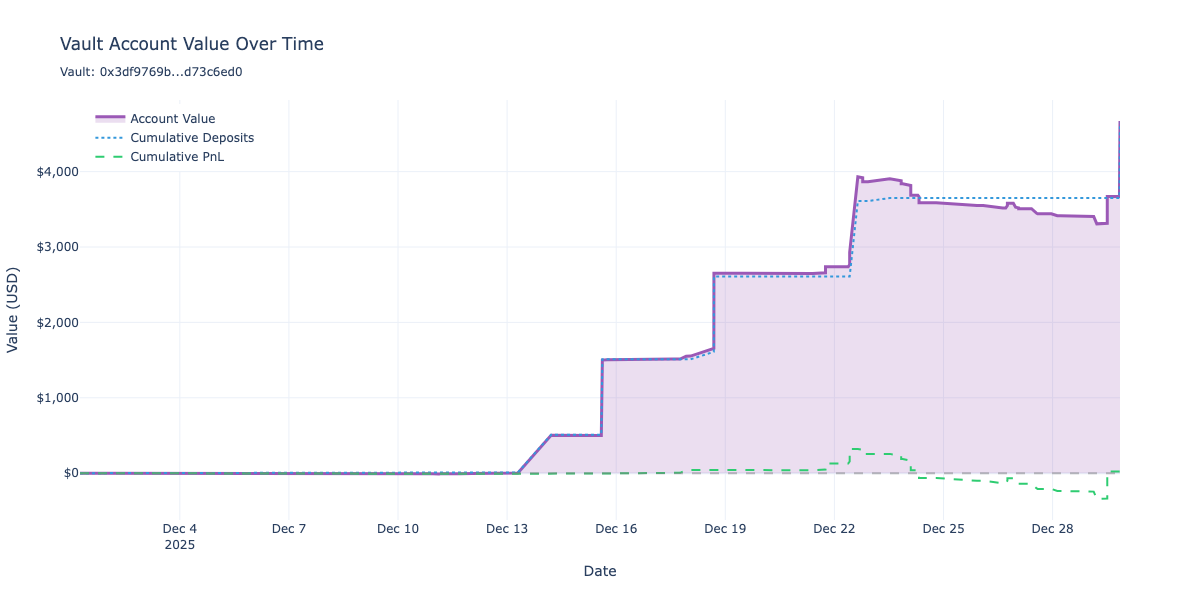

Account value

The previous sections analysed trading PnL and capital flows separately. To understand the true vault performance, we need to combine both into a single account value metric that tracks:

Cumulative PnL: Realised profit/loss from trading activity

Cumulative Net Flow: Total capital deposited minus withdrawn

Account Value: The sum of initial balance, net flows, and trading PnL

This combined view shows how the vault’s total value evolves over time, accounting for both trading performance and capital movements.

We use the analyse_positions_and_deposits() function to merge the position and deposit timelines into a unified DataFrame.

[40]:

from eth_defi.hyperliquid.combined_analysis import analyse_positions_and_deposits, get_combined_summary

# Combine position and deposit data into unified timeline

combined_df = analyse_positions_and_deposits(df, deposits_df)

# Show summary statistics

summary = get_combined_summary(combined_df)

summary_table = pd.DataFrame({

"Metric": [

"Total Events",

"Trading PnL",

"Net Capital Flow",

"Final Account Value",

"Max Account Value",

"Min Account Value",

"Max Drawdown",

],

"Value": [

summary["total_events"],

f"${summary['total_pnl']:,.2f}",

f"${summary['total_netflow']:,.2f}",

f"${summary['final_account_value']:,.2f}",

f"${summary['max_account_value']:,.2f}",

f"${summary['min_account_value']:,.2f}",

f"${summary['max_drawdown']:,.2f}",

]

})

display(summary_table.set_index("Metric"))

# Show the combined DataFrame

display(combined_df.tail())

| Value | |

|---|---|

| Metric | |

| Total Events | 138 |

| Trading PnL | $21.70 |

| Net Capital Flow | $4,650.00 |

| Final Account Value | $4,671.70 |

| Max Account Value | $4,671.70 |

| Min Account Value | $-9.94 |

| Max Drawdown | $-623.16 |

| pnl_update | netflow_update | cumulative_pnl | cumulative_netflow | cumulative_account_value | total_assets | total_supply | share_price | |

|---|---|---|---|---|---|---|---|---|

| timestamp | ||||||||

| 2025-12-29 20:07:28.020 | 0.00 | 0.00 | 21.70 | 3,650.00 | 3,671.70 | 3,671.70 | 3,468.21 | 1.06 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.00 | 21.70 | 3,650.00 | 3,671.70 | 3,671.70 | 3,468.21 | 1.06 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.00 | 21.70 | 3,650.00 | 3,671.70 | 3,671.70 | 3,468.21 | 1.06 |

| 2025-12-29 20:07:28.020 | 0.00 | 0.00 | 21.70 | 3,650.00 | 3,671.70 | 3,671.70 | 3,468.21 | 1.06 |

| 2025-12-29 20:28:58.122 | 0.00 | 1,000.00 | 21.70 | 4,650.00 | 4,671.70 | 4,671.70 | 4,412.79 | 1.06 |

Visualise account value over time

This chart shows the vault’s total account value evolution, combining both trading PnL and capital flows. The account value line represents what the vault would be worth at each point in time.

[41]:

if not combined_df.empty:

fig = go.Figure()

# Add account value line

fig.add_trace(go.Scatter(

x=combined_df.index,

y=combined_df["cumulative_account_value"],

mode="lines",

name="Account Value",

line=dict(color="#9b59b6", width=3),

fill="tozeroy",

fillcolor="rgba(155, 89, 182, 0.2)",

))

# Add cumulative net flow line for reference

fig.add_trace(go.Scatter(

x=combined_df.index,

y=combined_df["cumulative_netflow"],

mode="lines",

name="Cumulative Deposits",

line=dict(color="#3498db", width=2, dash="dot"),

))

# Add cumulative PnL line for reference

fig.add_trace(go.Scatter(

x=combined_df.index,

y=combined_df["cumulative_pnl"],

mode="lines",

name="Cumulative PnL",

line=dict(color="#2ecc71", width=2, dash="dash"),

))

fig.add_hline(y=0, line_dash="dash", line_color="grey", opacity=0.5)

fig.update_layout(

title=f"Vault Account Value Over Time<br><sub>Vault: {VAULT_ADDRESS[:10]}...{VAULT_ADDRESS[-8:]}</sub>",

xaxis_title="Date",

yaxis_title="Value (USD)",

template="plotly_white",

hovermode="x unified",

yaxis=dict(tickformat="$,.0f"),

legend=dict(yanchor="top", y=0.99, xanchor="left", x=0.01),

)

fig.show()

else:

print("No data available for account value visualisation")